how to lower property taxes in maryland

The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. So vacant land will likely have lower real estate taxes due to a lower assessed value.

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

The group wanted two Baltimore city charter amendments.

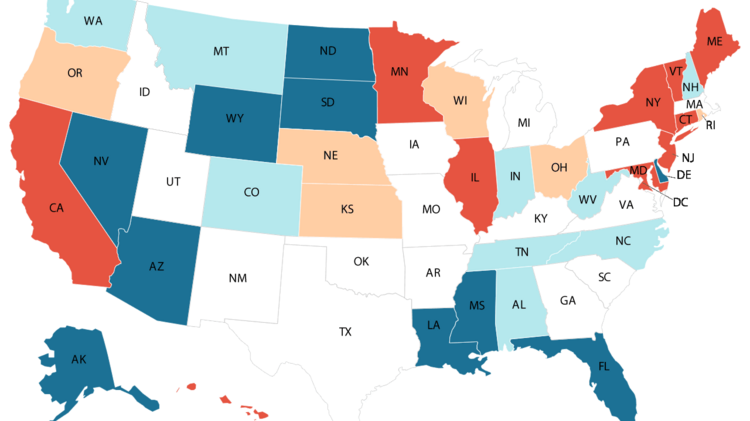

. Property taxes in New York vary greatly between New York City and the rest of the state. In order to determine the states with the highest and lowest property taxes WalletHub compared the 50 states and the District of Columbia by using US. Assessment is based on a unit called a mill equal to one-thousandth of a dollar.

Property taxes can vary greatly depending on the state that you live in. However because property values in Maryland are also high homeowners here pay more in annual property taxes than in most other states. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

Maryland homeowners with total household income of 60000 or less can be eligible for property tax reductions on a sliding scale. The average effective property tax rate in the Big Apple is just 088 while the statewide average rate is. Louisiana has one of the lowest median property tax rates in the United States with only states collecting a lower median property tax than Louisiana.

The current statistics show the overall average assessed value in the county increased about 30 and the anticipated tax increase in taxes collected is around 10 according to Konis. Median annual property tax payments in counties in Maryland range up to 5582. In New York City property tax rates are actually quite low.

The median property tax in Baltimore City Maryland is 1850 per year for a home worth the median value of 160400. The credit is calculated based on the 10 limit for purposes of the State property tax and 10 or less as determined by local governments for purposes of local taxation. The Tax Foundation is the nations leading independent tax policy nonprofit.

A household with a total income of 20000 should be paying no. Baltimore City collects on average 115 of a propertys assessed fair market value as property tax. Make sure you review your tax card and look at comparable homes.

Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. The course consists of 78 hours of instruction in Maryland 89 hours of instruction in Oregon and 89 hours of instruction in. That includes both the land itself and the structures on it.

Renew Baltimore needed 10000 signatures to sign its petitions to lower the citys property tax rate but fell about 1000 signatures short. Across the United States the mean effective property tax ratetotal real estate taxes paid divided by total home valuewas 103 for 2019 according to data from the Tax Foundation a tax. Marylands lower standard deduction extra local income tax rates bundled with higher real estate tax rates push it past Virginia as the highest taxes of the three for each income level we analyzed.

Instead it is actually a credit calculated on any assessment increase exceeding 10 or the lower cap enacted by the local governments from one year to the next. Value of your home. Baltimore City has one of the highest median property taxes in the United States and is ranked 543rd of the 3143 counties in order of median property taxes.

Census Bureau data to determine real-estate property tax rates and applying assumptions based on national auto-sales data to determine vehicle property tax rates. Property values are determined by assessor staff analyzing real estate sales in 969 statistical neighborhoods throughout the county he said. How is Florida Property Tax Calculated.

Whether you have a 10000 or 1000000 house you will owe real property taxes in Florida. This is mostly due to Virginias income tax cap at 575 compared to Washington DCs highest rate of 85 for the bulk of his income. Overview of New York Taxes.

There is no minimum or maximum of real property taxes you could owe in Florida. A financial advisor in Maryland can help you understand how homeownership fits into your overall financial goals. Louisianas median income is 54216 per year so the median yearly property tax paid by.

One petition was to lower the citys property tax rate over a six-year period by about 44 from 2248 to 1250 and then cap it.

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

Maryland Business Personal Property Tax A Guide

About Renew Baltimore Renew Baltimore

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

Maryland Property Tax Calculator Smartasset

Maryland Property Tax Calculator Smartasset

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Deducting Property Taxes H R Block

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Arlington Va Local News

Your Guide To Maryland Real Estate Taxes Upnest

Should The Wealthy Pay More Income Taxes Debate Divides Maryland Democrats Wamu

About Renew Baltimore Renew Baltimore

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group